Topic 6

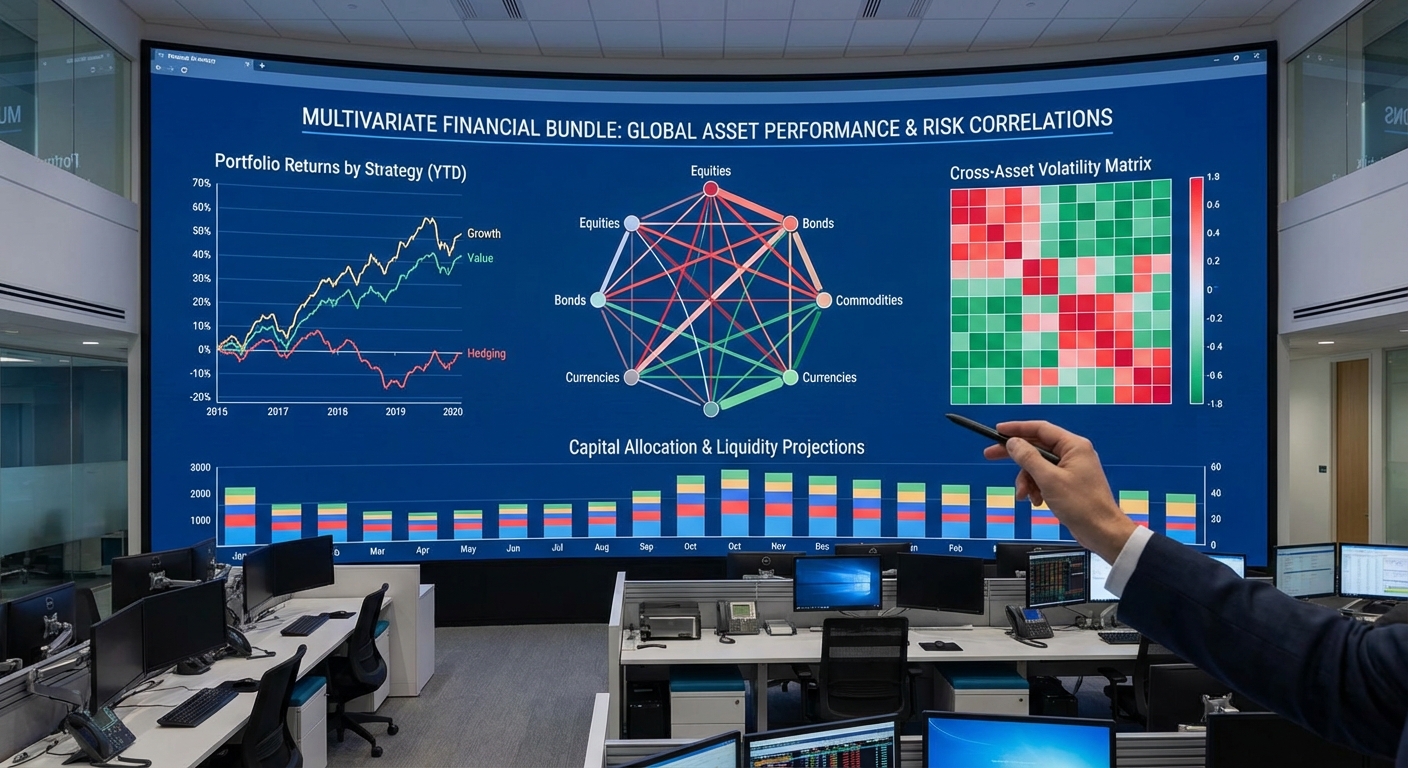

Multivariate Financial Time Series Bundle

Medium

+1 Bonus Point

Topic 6 – Multivariate Financial Time Series Bundle

Level: Medium Goal: Model several assets jointly (correlations, VAR, multivariate forecasting).Dataset

- Source: Financial Time Series Datasets – Kaggle

- Link: https://www.kaggle.com/datasets/praxitelisk/financial-time-series-datasets

Download Instructions

- Open the dataset page above.

- Click "Download".

- Extract to

data/financial/. - Choose some CSVs (indices, FX, commodities).

Data Loading

import pandas as pd

import os

print(os.listdir("data/financial"))

sp500 = pd.read_csv("data/financial/sp500.csv") # adjust

oil = pd.read_csv("data/financial/oil.csv") # adjust

for df_ in (sp500, oil):

df_["Date"] = pd.to_datetime(df_["Date"])

df_.set_index("Date", inplace=True)

df_.sort_index(inplace=True)

merged = sp500[["Close"]].rename(columns={"Close": "SP500"}).join(

oil[["Close"]].rename(columns={"Close": "OIL"}), how="inner"

)Implementation Steps

1. Data Exploration

- Load multiple financial time series (e.g., stock indices, commodities, FX)

- Select 3-5 series for multivariate analysis

- Align time indices (handle different frequencies)

- Inspect data quality and missing values

2. Exploratory Data Analysis (EDA)

- Plot each series individually

- Calculate pairwise correlations

- Visualize correlation matrix (heatmap)

- Analyze co-movements and relationships

- Perform time series decomposition for each series

3. Data Preprocessing

- Align series to common time index

- Handle missing values (forward fill, interpolation)

- Calculate returns for each asset

- Test each series for stationarity

- Apply transformations (differencing, log) as needed

4. Correlation Analysis

- Calculate correlation matrix of returns

- Analyze time-varying correlations (rolling correlations)

- Identify periods of high/low correlation

- Visualize correlation dynamics over time

5. Model Building

- Univariate Models (baseline):

- ARIMA for each series individually

- Multivariate Models:

- VAR (Vector Autoregression):

- Select optimal lag order (AIC/BIC)

- Estimate VAR model

- Granger causality tests

- VECM (Vector Error Correction Model):

- Test for cointegration (Johansen test)

- If cointegrated, estimate VECM

- Dynamic Correlation Models (advanced):

- DCC-GARCH for time-varying correlations

6. Model Evaluation

- Split data temporally

- Generate multivariate forecasts

- Calculate forecast accuracy for each series

- Compare univariate vs multivariate approaches

- Visualize joint forecasts

7. Portfolio Analysis (Optional)

- Construct portfolio weights

- Analyze portfolio returns and volatility

- Compare with individual asset performance

Expected Deliverables

- EDA Report:

- Individual series plots

- Correlation analysis and heatmaps

- Time-varying correlation plots

- Stationarity test results

- Model Results:

- VAR model parameters

- Cointegration test results (if applicable)

- Forecast accuracy comparison

- Multivariate forecast plots

- Granger causality results

- Code:

- Complete Python notebook

- Functions for multivariate analysis

- Visualization utilities

Tips

- Select related assets (e.g., stock indices, commodities) for meaningful relationships

- Align data frequencies (daily, weekly) before merging

- Returns are typically more stationary than prices

- VAR models require stationary series

- Test for cointegration if analyzing prices directly

- Use appropriate lag selection criteria (AIC, BIC, HQIC)

- Multivariate models can capture spillover effects between assets

- Consider economic/financial relationships when interpreting results

Starter Notebook

The starter notebook contains installation instructions and data loading code to help you get started with this topic.

Note: You can view the notebook directly on GitHub or download it to run locally in Jupyter.

Getting Started

This topic includes:

- README.md - Detailed implementation guide (this page)

- starter.ipynb - Jupyter notebook with installation and data loading code

- Featured image - Visual representation of the topic

Navigate to the Topic/6.Multivariate_Financial/ directory to access all resources.