Topic 5

Single-Stock Case Study: NVIDIA (NVDA)

Medium

+1 Bonus Point

Topic 5 – Single-Stock Case Study: NVIDIA (NVDA)

Level: Medium Goal: Univariate forecasting and volatility exploration for a single stock.Dataset

- Source: NVIDIA (NVDA) Historical Stock Price Data – Kaggle

- Link: https://www.kaggle.com/datasets/elnazalikarami/nvidia-corporation-stock-historical-quotes

Download Instructions

- Open the dataset link above.

- Click "Download".

- Extract to

data/. - Use the main CSV (e.g.

HistoricalData_....csv).

Data Loading

import pandas as pd

df = pd.read_csv("data/NVDA_HistoricalData.csv") # adjust filename

df["Date"] = pd.to_datetime(df["Date"])

df = df.set_index("Date").sort_index()Implementation Steps

1. Data Exploration

- Load NVIDIA stock price data

- Inspect OHLC (Open, High, Low, Close) and Volume data

- Focus on Close price for forecasting

- Calculate returns (simple and log returns)

- Examine trading volume patterns

2. Exploratory Data Analysis (EDA)

- Plot stock price over time

- Plot returns distribution

- Analyze volatility clustering

- Calculate and visualize rolling statistics (mean, std)

- Perform time series decomposition

- Analyze ACF/PACF of prices and returns

3. Volatility Analysis

- Calculate realized volatility (rolling standard deviation of returns)

- Identify volatility regimes (high vs low volatility periods)

- Analyze volatility clustering (GARCH-like patterns)

- Plot volatility over time

4. Stationarity Analysis

- Test stock prices for stationarity (typically non-stationary)

- Test returns for stationarity (typically stationary)

- Apply differencing to prices if needed

- Consider log transformation

5. Model Building

- Price Forecasting:

- ARIMA models on prices or log prices

- Consider trend models

- Returns Modeling (optional):

- ARMA models on returns

- GARCH models for volatility (if time permits)

- Model Selection:

- Use AIC/BIC for comparison

- Validate on hold-out set

6. Model Evaluation

- Split data temporally (e.g., last 20% as test)

- Generate price forecasts

- Calculate accuracy metrics (MAE, RMSE, MAPE)

- Analyze forecast errors

- Visualize forecasts with confidence intervals

7. Volatility Forecasting (Advanced)

- If implementing GARCH:

- Model volatility dynamics

- Forecast future volatility

- Compare with realized volatility

Expected Deliverables

- EDA Report:

- Stock price and returns plots

- Volatility analysis

- Decomposition plots

- ACF/PACF analysis

- Model Results:

- Selected model with parameters

- Price forecast accuracy

- Volatility analysis (if applicable)

- Forecast plots

- Code:

- Complete Python notebook

- Functions for price/returns analysis

- Volatility calculation utilities

Tips

- Stock prices are typically non-stationary; use returns or differencing

- NVIDIA is a tech stock with high volatility - expect large price swings

- Consider external events (earnings, product launches) that affect prices

- Volatility clustering is common in stock returns

- Use log returns for better statistical properties

- Consider multiple forecast horizons (1-day, 1-week, 1-month)

- Document any major events (splits, earnings) that affect the series

Starter Notebook

The starter notebook contains installation instructions and data loading code to help you get started with this topic.

Note: You can view the notebook directly on GitHub or download it to run locally in Jupyter.

Getting Started

This topic includes:

- README.md - Detailed implementation guide (this page)

- starter.ipynb - Jupyter notebook with installation and data loading code

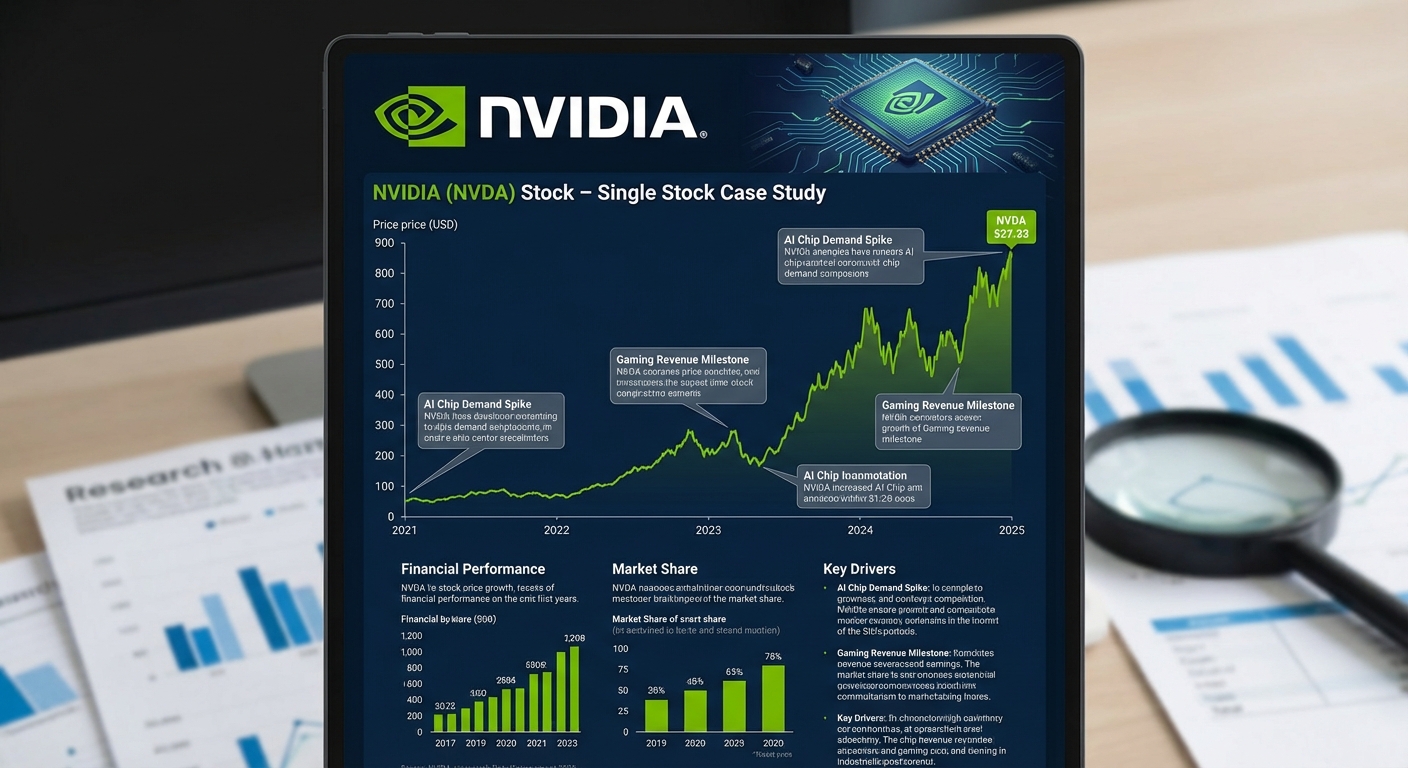

- Featured image - Visual representation of the topic

Navigate to the Topic/5.NVIDIA_Stock/ directory to access all resources.