Topic 4

US Macroeconomic Indicators

Medium

+1 Bonus Point

Topic 4 – US Macroeconomic Indicators (Kaggle)

Level: Medium Goal: Model and forecast key US macro indicators (unemployment, inflation, etc.).Dataset

- Source: U.S. Economic Time Series – Kaggle

- Link: https://www.kaggle.com/datasets/utkarshx27/us-economic-time-series

Download Instructions

- Open the dataset link above.

- Click "Download".

- Extract to

data/. - Use the main CSV, e.g.

USEconomicData.csv.

Data Loading

import pandas as pd

df = pd.read_csv("data/USEconomicData.csv") # adjust filename

df["DATE"] = pd.to_datetime(df["DATE"])

df = df.set_index("DATE").sort_index()Implementation Steps

1. Data Exploration

- Load dataset and explore available indicators

- Select key indicators to analyze (e.g., unemployment rate, inflation, GDP, interest rates)

- Inspect data frequency (monthly, quarterly, annual)

- Check for missing values and data quality issues

2. Exploratory Data Analysis (EDA)

- Plot each selected indicator over time

- Identify trends, cycles, and structural breaks

- Calculate correlations between indicators

- Perform time series decomposition for each series

- Analyze ACF/PACF for each indicator

3. Stationarity Analysis

- Test each indicator for stationarity (ADF test)

- Apply appropriate transformations (differencing, log transformation)

- Handle non-stationarity appropriately

- Document transformation decisions

4. Model Building

- Univariate Models:

- ARIMA/SARIMA for each indicator individually

- Model selection using AIC/BIC

- Multivariate Models (optional):

- VAR (Vector Autoregression) models

- Analyze relationships between indicators

- Granger causality tests

5. Model Evaluation

- Split data temporally (keep recent data for testing)

- Generate forecasts for each indicator

- Calculate forecast accuracy metrics (MAE, RMSE, MAPE)

- Compare univariate vs multivariate approaches

- Visualize forecasts with actual values

6. Economic Interpretation

- Interpret model results in economic context

- Discuss relationships between indicators

- Analyze forecast implications

- Compare with economic theory

Expected Deliverables

- EDA Report:

- Time series plots for each indicator

- Correlation analysis

- Decomposition plots

- Stationarity test results

- Model Results:

- Model parameters for each indicator

- Performance metrics table

- Forecast plots

- Economic interpretation

- Code:

- Complete Python notebook

- Functions for indicator analysis

- Visualization utilities

Tips

- Macroeconomic indicators often have strong trends and cycles

- Consider external factors (recessions, policy changes) in analysis

- VAR models can capture relationships between indicators

- Use appropriate frequency (monthly vs quarterly) based on data availability

- Economic indicators may have different units - normalize for comparison

- Consider leading/lagging relationships between indicators

- Document economic context and policy implications

Starter Notebook

The starter notebook contains installation instructions and data loading code to help you get started with this topic.

Note: You can view the notebook directly on GitHub or download it to run locally in Jupyter.

Getting Started

This topic includes:

- README.md - Detailed implementation guide (this page)

- starter.ipynb - Jupyter notebook with installation and data loading code

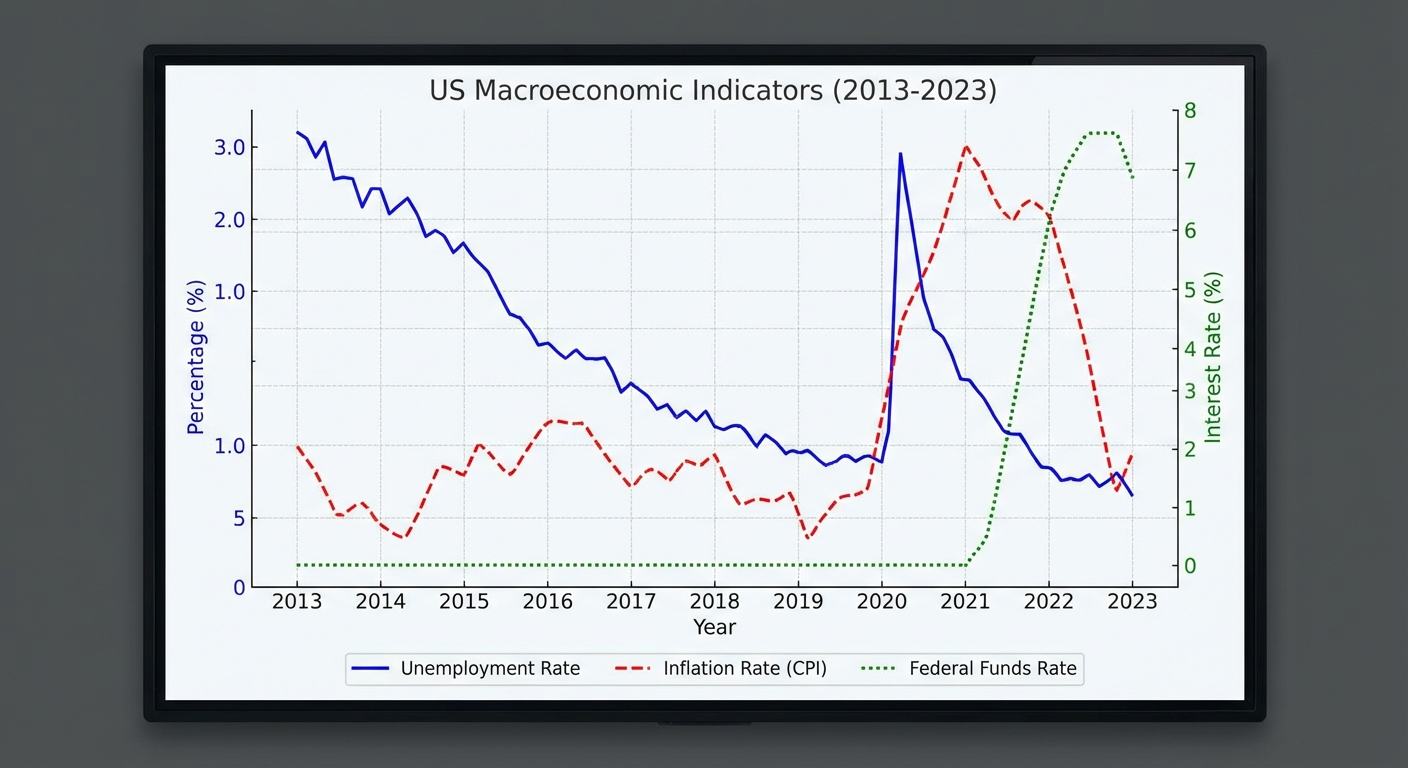

- Featured image - Visual representation of the topic

Navigate to the Topic/4.US_Macro/ directory to access all resources.