Time Series Problem Set: Autocorrelation Function (ACF)

Complete Problem Set with Solutions - Undergraduate Level

Exercise Type 1: Numerical ACF Calculation

Problem 1.1

Given the time series: x = [2, 4, 6, 8, 10]

Compute:

- The sample mean x̄

- The sample variance s²

- The autocovariance γ(k) for lags k = 0, 1, 2

- The autocorrelation ρ(k) for lags k = 0, 1, 2

Solution 1.1

Key

1. Sample mean: x̄ = 6

2. Sample variance: s² = 10

3. Autocovariance: γ(0) = 8, γ(1) = 3.2, γ(2) = -0.8

4. Autocorrelation: ρ(0) = 1.0, ρ(1) = 0.4, ρ(2) = -0.1

Explanation (how we get these numbers)

Mean: x̄ = (2 + 4 + 6 + 8 + 10) / 5 = 30 / 5 = 6.

Variance: Use s² = (1/(n−1)) Σ (xᵢ − x̄)². Deviations from mean: (2−6, 4−6, 6−6, 8−6, 10−6) = (−4, −2, 0, 2, 4). So s² = [(−4)² + (−2)² + 0² + 2² + 4²] / 4 = 40 / 4 = 10.

Autocovariance: Use γ(k) = (1/(n−k)) Σ (xᵢ − x̄)(xᵢ₊ₖ − x̄) with demeaned series. For k = 0: γ(0) = (1/5)[(−4)² + (−2)² + 0² + 2² + 4²] = 40/5 = 8 (same as variance up to divisor). For k = 1: pairs (x₁−x̄)(x₂−x̄), (x₂−x̄)(x₃−x̄), … → (−4)(−2)+(−2)(0)+(0)(2)+(2)(4) = 8+0+0+8 = 16, and n−k = 4, so γ(1) = 16/4 = 3.2. For k = 2: three pairs; sum = (−4)(0)+(−2)(2)+(0)(4) = −4, γ(2) = −4/3 ≈ −0.8.

Autocorrelation: ρ(k) = γ(k) / γ(0). So ρ(0) = 1, ρ(1) = 3.2/8 = 0.4, ρ(2) = −0.8/8 = −0.1.

Problem 1.2

Given the time series: x = [5, 5, 5, 5, 5]

Compute the autocovariance and autocorrelation. What happens when all values are identical?

Solution 1.2

Key

Sample mean x̄ = 5. Sample variance s² = 0. Autocovariance γ(0) = 0, γ(k) = 0 for k > 0. Autocorrelation is undefined (we cannot divide by γ(0) = 0).

Problem 1.3

Given the time series: x = [10, 8, 6, 4, 2]

Compute the autocovariance γ(k) and autocorrelation ρ(k) for lags k = 0, 1, 2.

Solution 1.3

Key

Sample mean x̄ = 6. Sample variance s² = 10. γ(0) = 8, γ(1) = 3.2, γ(2) = −0.8. ρ(0) = 1.0, ρ(1) = 0.4, ρ(2) = −0.1.

Problem 1.4

Given the time series: x = [3, 7, 3, 7, 3]

Compute the autocovariance and autocorrelation for lags k = 0, 1, 2, 3.

Solution 1.4

Key

Sample mean x̄ = 4.6. Sample variance s² = 4.8. γ(0) = 3.84, γ(1) = −3.072, γ(2) = 2.176, γ(3) = −1.536. ρ(0) = 1.0, ρ(1) = −0.8, ρ(2) ≈ 0.567, ρ(3) = −0.4.

Problem 1.5

Given the time series: x = [12, 15, 18, 12, 15, 18, 12]

Compute the autocovariance and autocorrelation for lags k = 0, 1, 2, 3.

Solution 1.5

Key

Sample mean x̄ ≈ 14.571. Sample variance s² ≈ 7.286. γ(0) ≈ 6.245, γ(1) ≈ −2.554, γ(2) ≈ −2.554, γ(3) ≈ 5.298. ρ(0) = 1.0, ρ(1) ≈ −0.409, ρ(2) ≈ −0.409, ρ(3) ≈ 0.848.

Exercise Type 2: Effect of Mean Removal

Problem 2.1

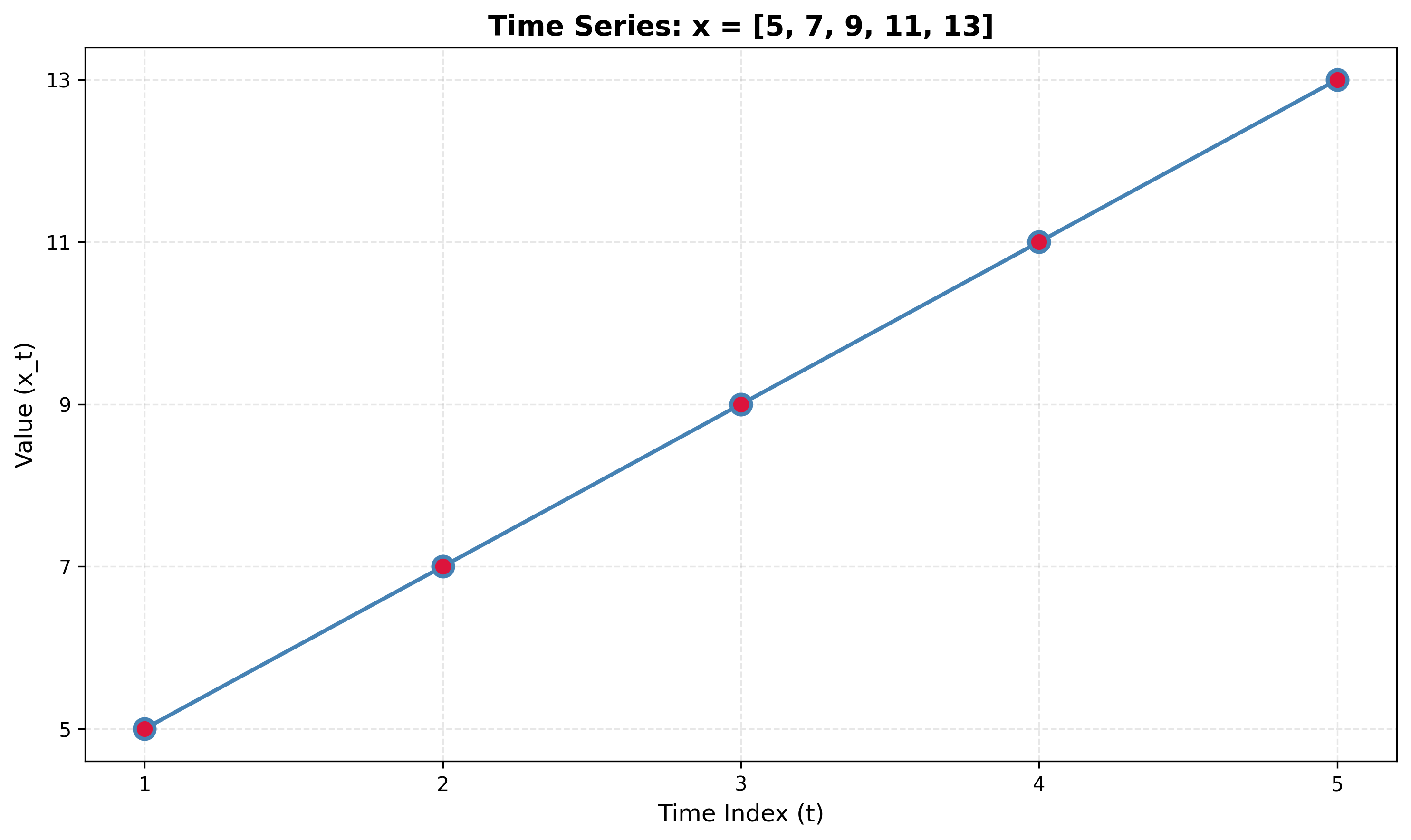

Given the time series: x = [5, 7, 9, 11, 13]

- Compute the autocovariance without removing the mean.

- Compute the autocovariance with mean removal.

- Compare the results and explain why mean removal is necessary.

Solution 2.1

Key

Without mean removal: γ(0) = 89, γ(1) = 68, ρ(1) = 68/89 ≈ 0.764.

With mean removal: γ(0) = 8, γ(1) = 3.2, ρ(1) = 3.2/8 = 0.4.

Problem 2.2

Given the time series: x = [100, 102, 104, 106, 108]

- Compute autocorrelation at lag 1 without mean removal.

- Compute autocorrelation at lag 1 with mean removal.

- Explain the difference.

Solution 2.2

Key

Without mean removal: ρ(1) ≈ 0.799. With mean removal: ρ(1) = 0.4.

Problem 2.3

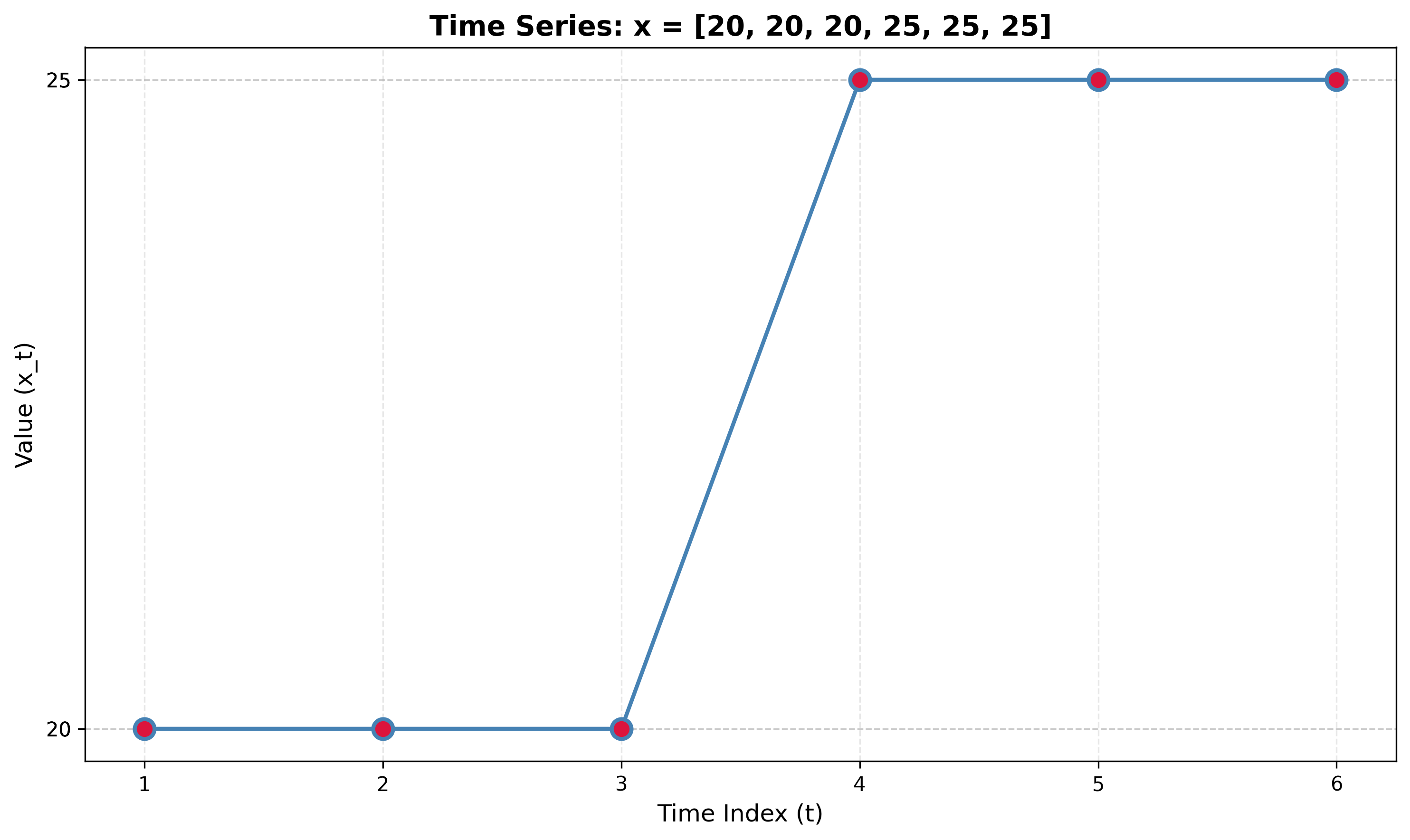

Given the time series: x = [20, 20, 20, 25, 25, 25]

Compare the autocorrelation at lag 1 computed with and without mean removal. What does this tell you about the series?

Solution 2.3

Key

Without mean removal: ρ(1) ≈ 0.829. With mean removal: ρ(1) = 0.5.

Problem 2.4

Given the time series: x = [1, 3, 5, 1, 3, 5]

Compute autocorrelation at lag 2 with and without mean removal. Explain why the results differ.

Solution 2.4

Key

Without mean removal: ρ(2) ≈ 0.4 (positive). With mean removal: ρ(2) = −0.5 (negative).

Problem 2.5

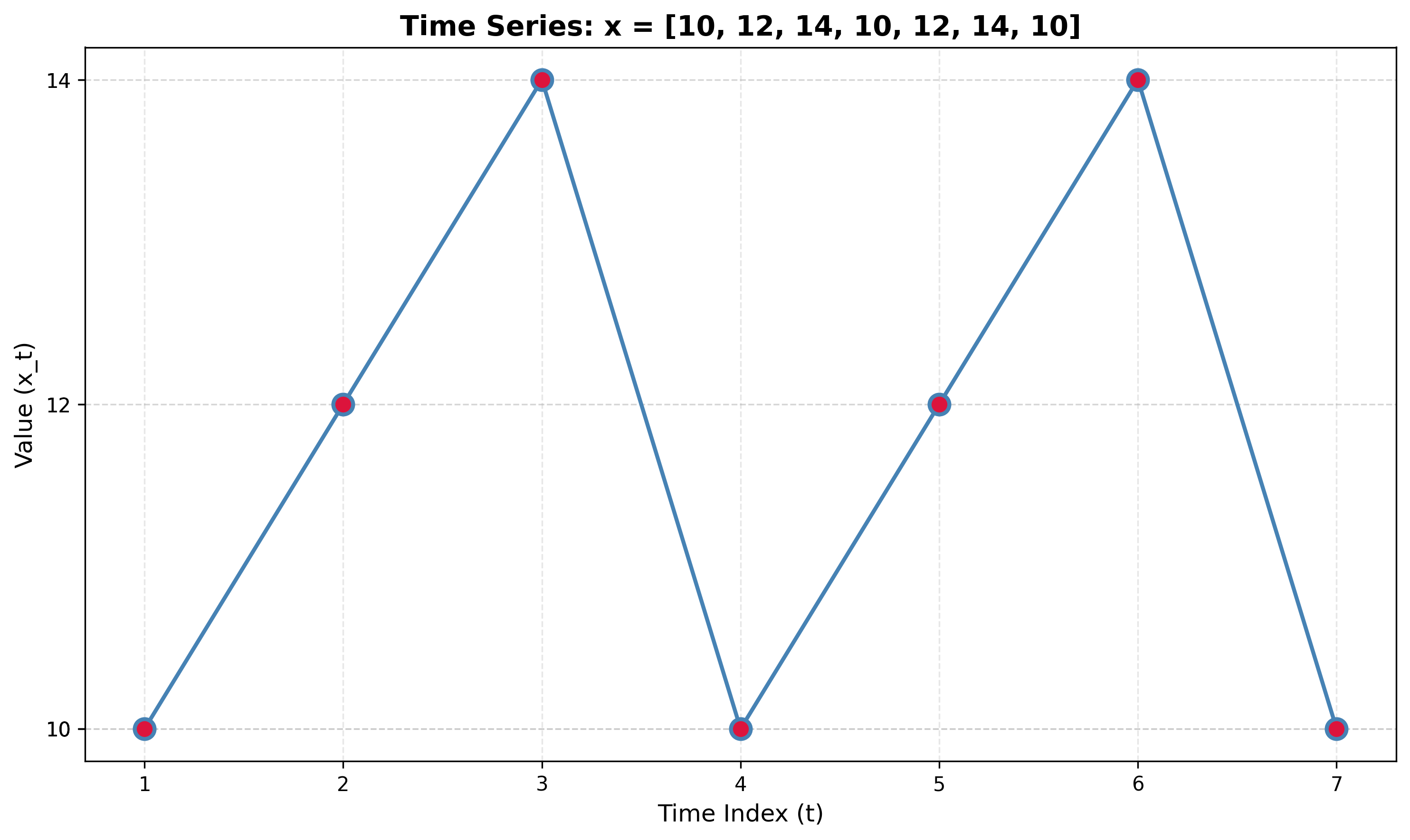

Given the time series: x = [10, 12, 14, 10, 12, 14, 10]

- Compute autocorrelation at lag 3 with and without mean removal.

- Explain which method gives the correct interpretation of the series' periodic structure.

Solution 2.5

Key

Without mean removal: ρ(3) ≈ 0.551. With mean removal: ρ(3) ≈ 0.729.

Exercise Type 3: Interpreting ACF Patterns

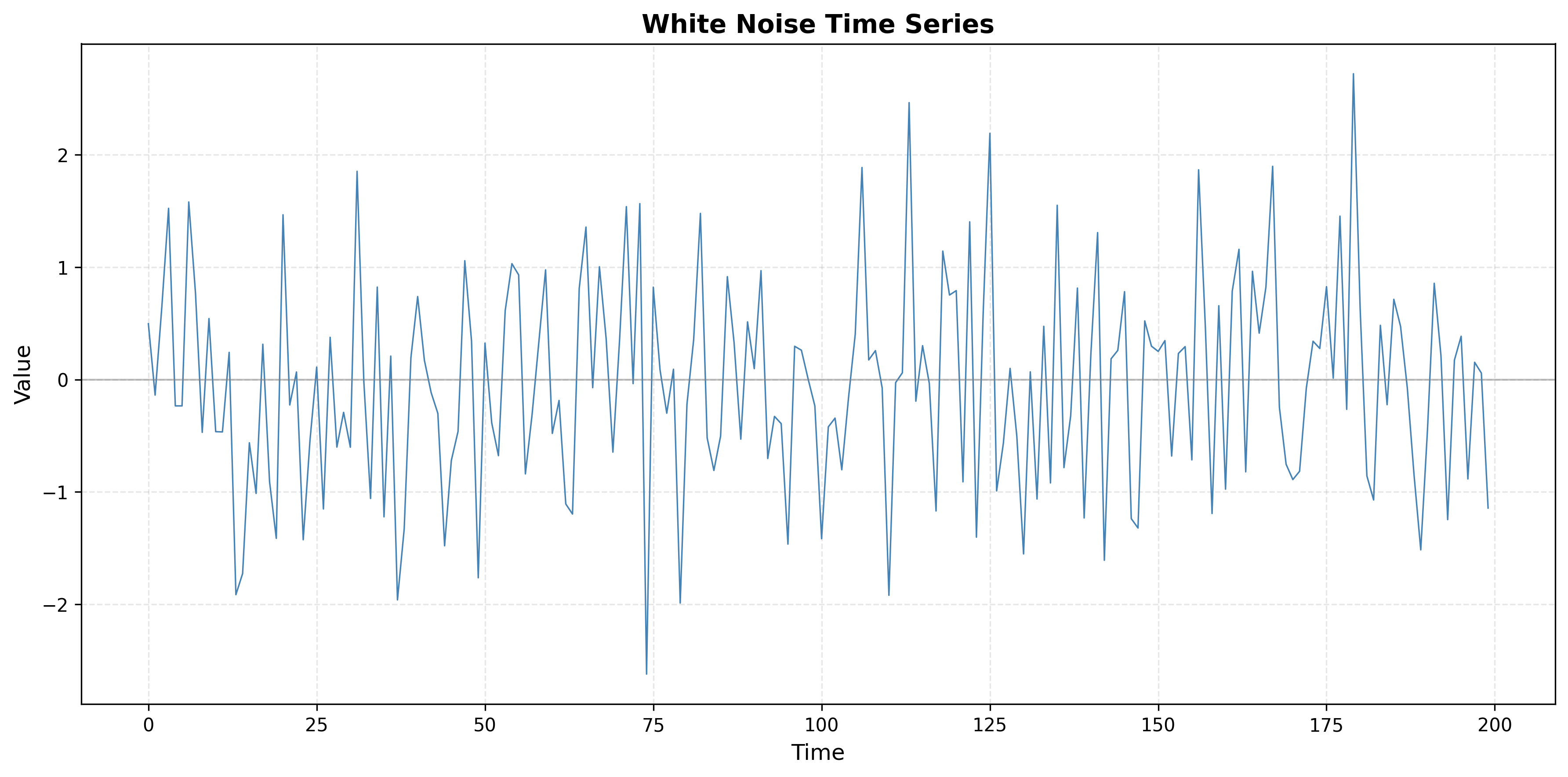

Problem 3.1

A time series has an ACF plot where ρ(0) = 1 and ρ(k) ≈ 0 for all k > 0, with values randomly scattered around zero within the confidence bands.

- What type of process does this indicate?

- What are the characteristics of such a process?

- Generate a synthetic time series with this ACF pattern and plot both the series and its ACF.

Solution 3.1

Key

1. Process type: White noise.

2. Characteristics: No serial correlation (ρ(k) ≈ 0 for k > 0); constant mean and variance (stationary); no predictable pattern; observations uncorrelated across time; used as a baseline for model diagnostics (e.g. residuals should look like white noise).

3. Illustration: The code below generates white noise and plots the series and its ACF. You should see ρ(0) = 1 and ρ(k) near zero within the confidence bands.

Python code (runnable)

import numpy as np

import matplotlib.pyplot as plt

from statsmodels.tsa.stattools import acf

from statsmodels.graphics.tsaplots import plot_acf

# Set random seed for reproducibility

np.random.seed(42)

# Generate white noise time series

n = 200

white_noise = np.random.normal(loc=0, scale=1, size=n)

# Create time index

time = np.arange(n)

# Plot the time series

plt.figure(figsize=(14, 5))

plt.subplot(1, 2, 1)

plt.plot(time, white_noise, linewidth=0.8, color='steelblue')

plt.title('White Noise Time Series', fontsize=14, fontweight='bold')

plt.xlabel('Time', fontsize=12)

plt.ylabel('Value', fontsize=12)

plt.grid(True, alpha=0.3)

# Compute and plot ACF

plt.subplot(1, 2, 2)

plot_acf(white_noise, lags=40, alpha=0.05, ax=plt.gca())

plt.title('ACF Plot: White Noise', fontsize=14, fontweight='bold')

plt.xlabel('Lag', fontsize=12)

plt.ylabel('Autocorrelation', fontsize=12)

plt.grid(True, alpha=0.3)

plt.tight_layout()

plt.show()Problem 3.2

A time series has an ACF plot showing ρ(k) that decays very slowly, remaining positive and significant even at large lags (e.g., ρ(20) > 0.5).

- What does this pattern indicate?

- What type of non-stationarity is likely present?

- Generate a synthetic time series with this ACF pattern and plot both the series and its ACF.

Solution 3.2

Key

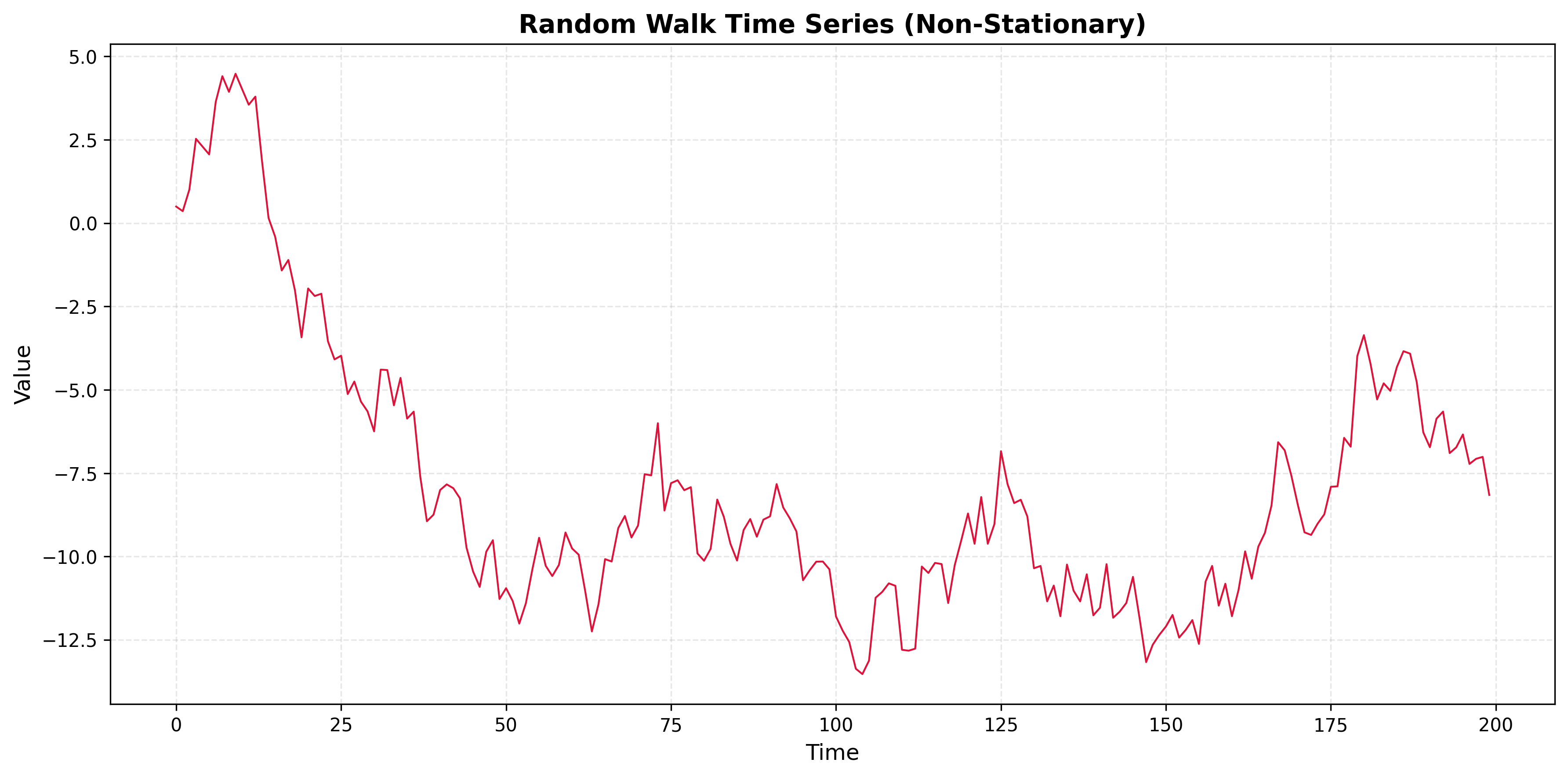

1. Pattern: Trend or non-stationary process. Slow decay of ρ(k) with no cutoff suggests long memory, usually from a deterministic or stochastic trend.

2. Non-stationarity: Likely a deterministic trend (e.g. linear), a random walk, or a unit-root process. First differencing is often needed to obtain a stationary series.

3. Illustration: The code below shows two examples: (i) linear trend + noise and (ii) random walk. Both produce ACFs that decay slowly and stay positive at large lags.

import numpy as np

import matplotlib.pyplot as plt

from statsmodels.graphics.tsaplots import plot_acf

n = 200

np.random.seed(42)

# Option 1: Linear trend + noise

trend_series = 0.05 * np.arange(n) + np.random.normal(0, 1, n)

# Option 2: Random walk

random_walk = np.cumsum(np.random.normal(0, 1, n))

fig, axes = plt.subplots(2, 2, figsize=(12, 8))

axes[0,0].plot(trend_series); axes[0,0].set_title('Trend + noise')

plot_acf(trend_series, lags=40, ax=axes[0,1]); axes[0,1].set_title('ACF')

axes[1,0].plot(random_walk); axes[1,0].set_title('Random walk')

plot_acf(random_walk, lags=40, ax=axes[1,1]); axes[1,1].set_title('ACF')

plt.tight_layout(); plt.show()Problem 3.3

A time series has an ACF plot showing oscillatory (sinusoidal) behavior, with autocorrelations alternating between positive and negative values in a periodic pattern.

- What does this pattern indicate?

- What type of seasonality or cyclical behavior is present?

- Generate a synthetic time series with this ACF pattern and plot both the series and its ACF.

Solution 3.3

Key

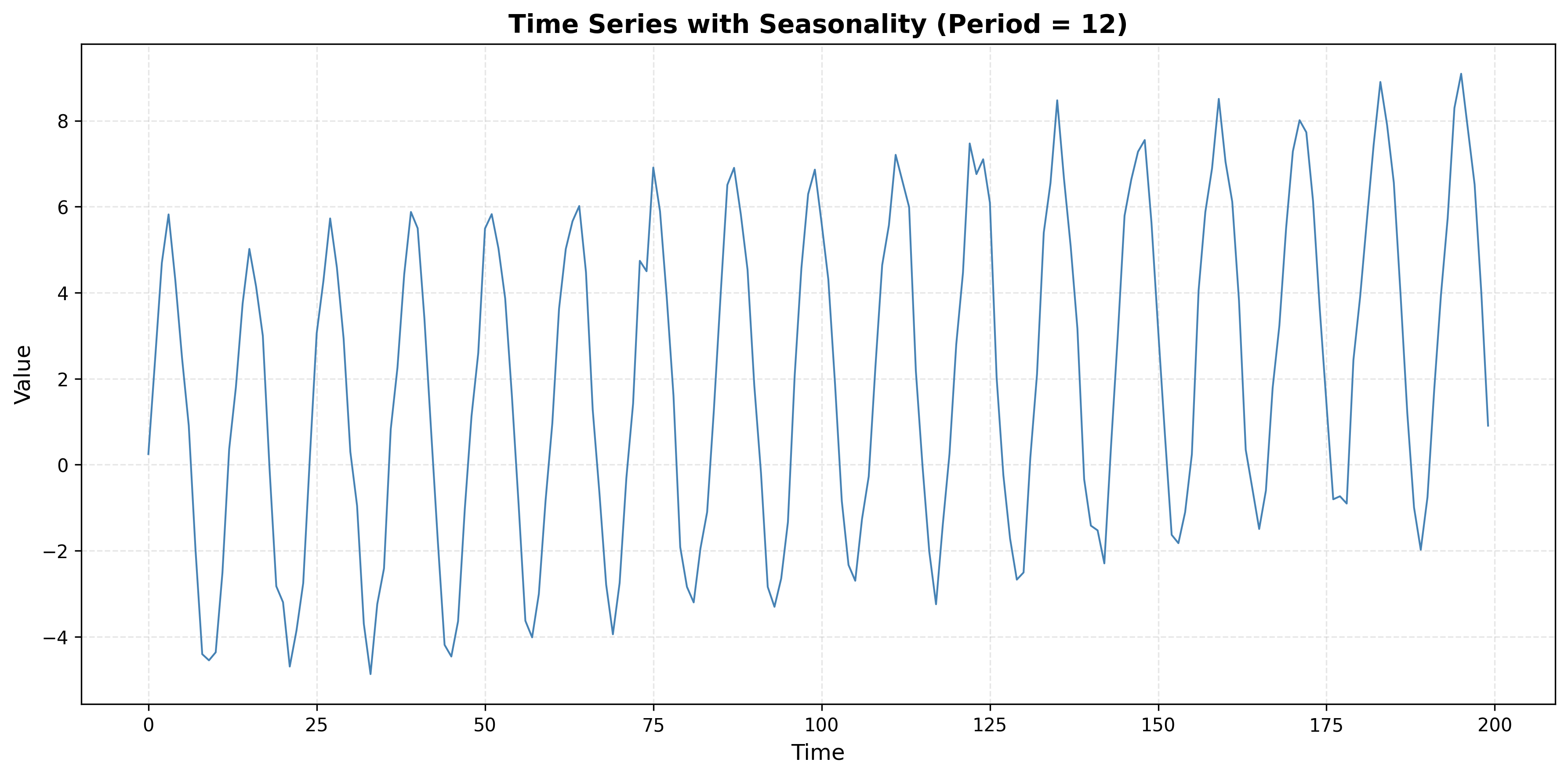

1. Pattern: Seasonality or cyclical behavior. Oscillating ACF (positive/negative by lag) indicates a periodic component in the series.

2. Type: Deterministic seasonality, a cyclical (e.g. sinusoidal) component, or a seasonal AR/MA structure. The period of the oscillation in the ACF matches the seasonal period.

3. Illustration: The code below builds a series with a sinusoidal component (period 12) plus trend and noise. The ACF will show oscillatory (sinusoidal) decay.

import numpy as np

import matplotlib.pyplot as plt

from statsmodels.graphics.tsaplots import plot_acf

n = 200

np.random.seed(42)

t = np.arange(n)

seasonal = 5 * np.sin(2 * np.pi * t / 12)

series = 0.02 * t + seasonal + np.random.normal(0, 0.5, n)

fig, ax = plt.subplots(1, 2, figsize=(12, 4))

ax[0].plot(series); ax[0].set_title('Seasonal series')

plot_acf(series, lags=50, ax=ax[1]); ax[1].set_title('ACF')

plt.tight_layout(); plt.show()Problem 3.4

A time series has an ACF plot where ρ(k) shows a sharp cutoff after lag q = 2, with ρ(1) and ρ(2) being significant, but ρ(k) ≈ 0 for all k > 2.

- What type of process does this suggest?

- What is the likely model order?

- Generate a synthetic time series with this ACF pattern and plot both the series and its ACF.

Solution 3.4

Key

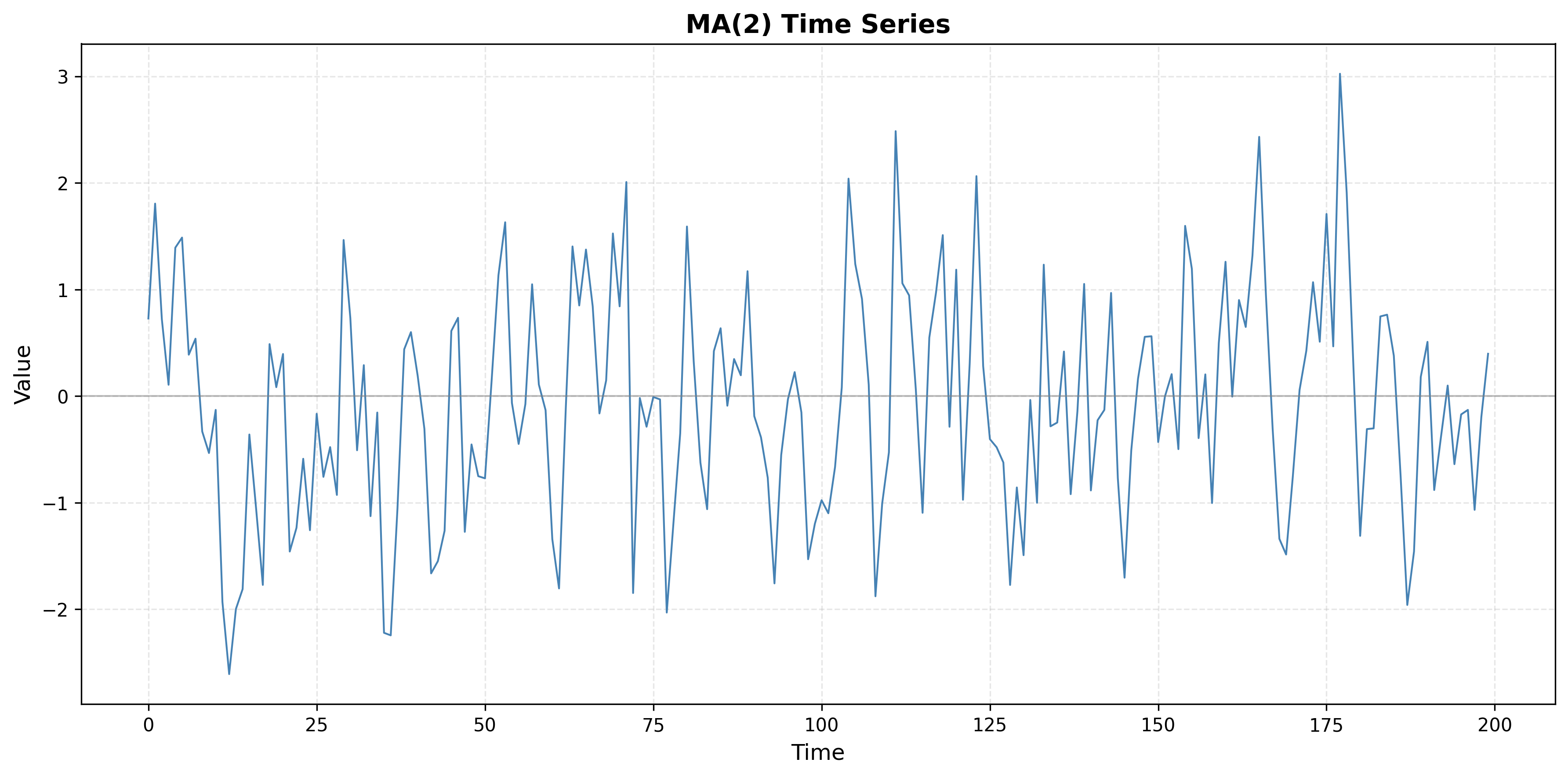

1. Process type: Moving Average of order 2, MA(2). ACF that is significant at lags 1 and 2 and then cuts off to (approximately) zero is the hallmark of an MA(q) process with q = 2.

2. Model order: MA(2) or ARIMA(0, 0, 2).

3. Illustration: The code below simulates an MA(2) process and plots the series and ACF. You should see ρ(1) and ρ(2) significant and ρ(k) ≈ 0 for k > 2.

from statsmodels.tsa.arima_process import ArmaProcess

import matplotlib.pyplot as plt

from statsmodels.graphics.tsaplots import plot_acf

ar_coeffs, ma_coeffs = np.array([1]), np.array([1, 0.5, 0.3]) # MA(2)

ma2_series = ArmaProcess(ar_coeffs, ma_coeffs).generate_sample(nsample=200)

fig, ax = plt.subplots(1, 2, figsize=(12, 4))

ax[0].plot(ma2_series); ax[0].set_title('MA(2) series')

plot_acf(ma2_series, lags=20, ax=ax[1]); ax[1].set_title('ACF')

plt.tight_layout(); plt.show()Problem 3.5

A time series has an ACF plot showing exponential decay: ρ(k) starts high and decays gradually, remaining positive but decreasing, with no sharp cutoff.

- What type of process does this indicate?

- How does this differ from the MA process pattern?

- Generate a synthetic time series with this ACF pattern and plot both the series and its ACF.

Solution 3.5

Key

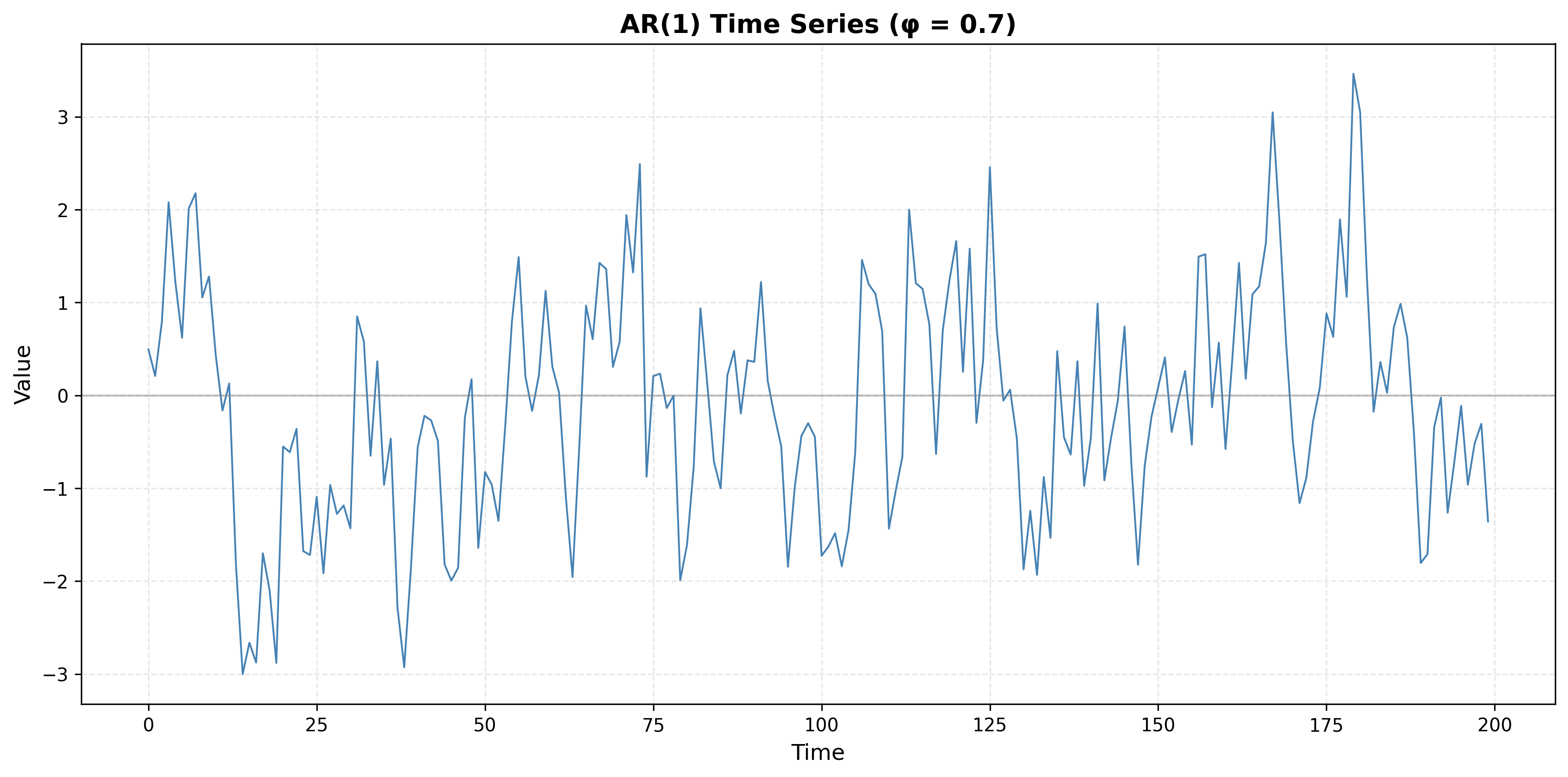

1. Process type: Autoregressive (AR) process. Gradual (exponential) decay of ρ(k) with no sharp cutoff is typical of AR processes.

2. Difference from MA: AR: ACF decays gradually (exponential or damped sinusoid). MA: ACF cuts off sharply after lag q (ρ(k) ≈ 0 for k > q). So “exponential decay, no cutoff” ⇒ AR; “significant for a few lags then zero” ⇒ MA.

3. Illustration: The code below simulates an AR(1) process (φ = 0.7). The ACF should decay roughly as ρ(k) ∝ 0.7^k.

from statsmodels.tsa.arima_process import ArmaProcess

import matplotlib.pyplot as plt

from statsmodels.graphics.tsaplots import plot_acf

ar_coeffs, ma_coeffs = np.array([1, -0.7]), np.array([1]) # AR(1)

ar1_series = ArmaProcess(ar_coeffs, ma_coeffs).generate_sample(nsample=200)

fig, ax = plt.subplots(1, 2, figsize=(12, 4))

ax[0].plot(ar1_series); ax[0].set_title('AR(1) series')

plot_acf(ar1_series, lags=20, ax=ax[1]); ax[1].set_title('ACF (exponential decay)')

plt.tight_layout(); plt.show()Exercise Type 4: Physiological Time-Series Interpretation

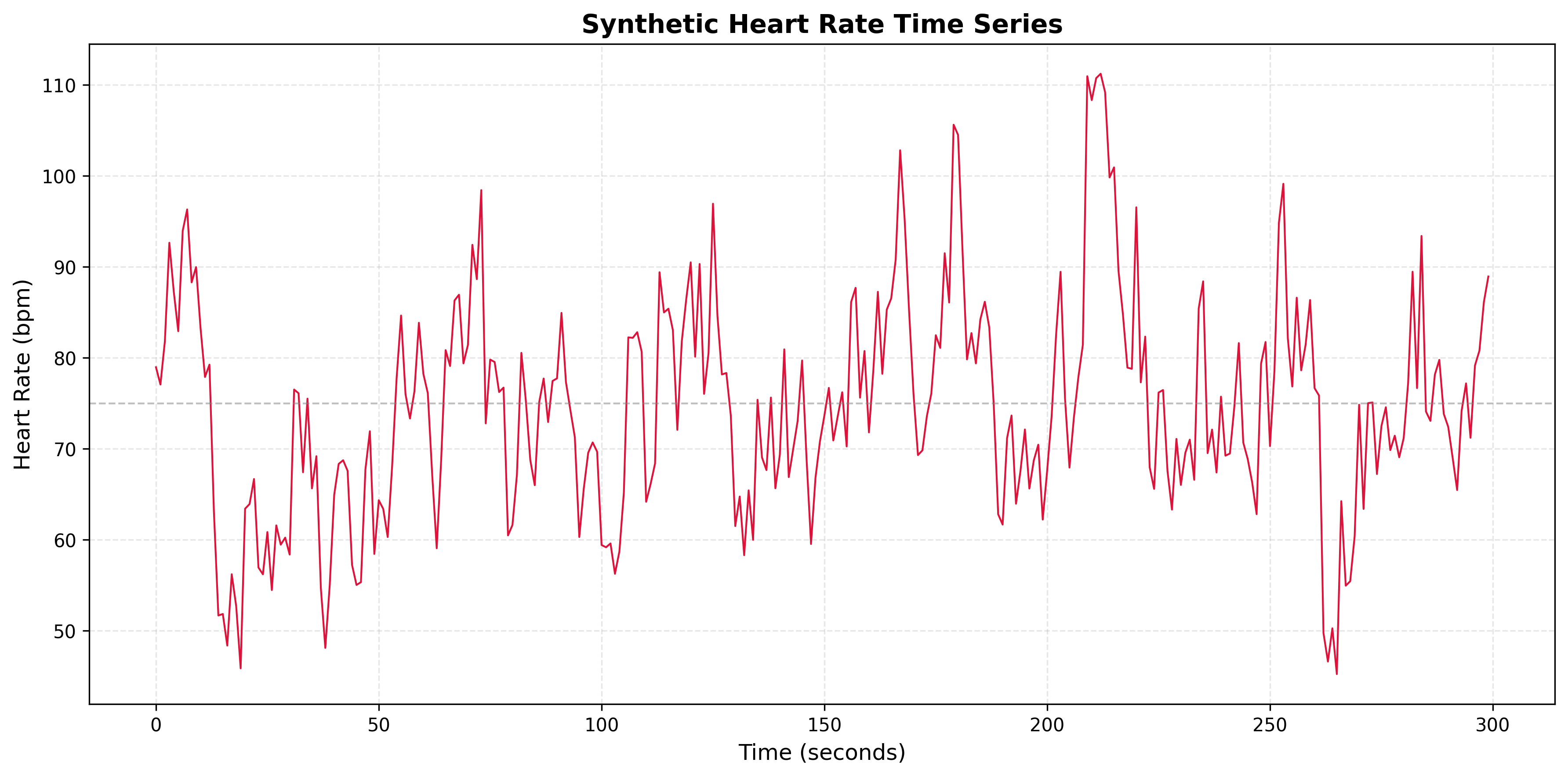

Problem 4.1

Consider a heart rate time series where the ACF shows:

- Strong positive autocorrelation at lag 1 (ρ(1) ≈ 0.8)

- Rapid decay to near zero by lag 5

- No significant periodic patterns

- What does this tell you about the memory length of the process?

- What AR/MA/ARIMA model order would be appropriate?

- Would deep learning be necessary for forecasting?

- Generate a synthetic heart rate time series with these characteristics and plot the series and ACF.

Solution 4.1

Key

1. Memory length: Short memory—ACF decays to near zero by lag 5, so the process “forgets” after about 5 steps.

2. Model order: AR(1) or ARIMA(1, 0, 0) is appropriate (exponential decay with no sharp cutoff ⇒ AR(1)).

3. Deep learning: No. The ACF is simple (exponential decay, short memory), so classical AR/ARIMA is sufficient. Deep learning is more useful when the dependence is long, nonlinear, or high-dimensional.

4. Illustration: Simulate an AR(1) with φ ≈ 0.8 to get ρ(1) ≈ 0.8 and rapid decay; plot the series and ACF to match the described pattern.

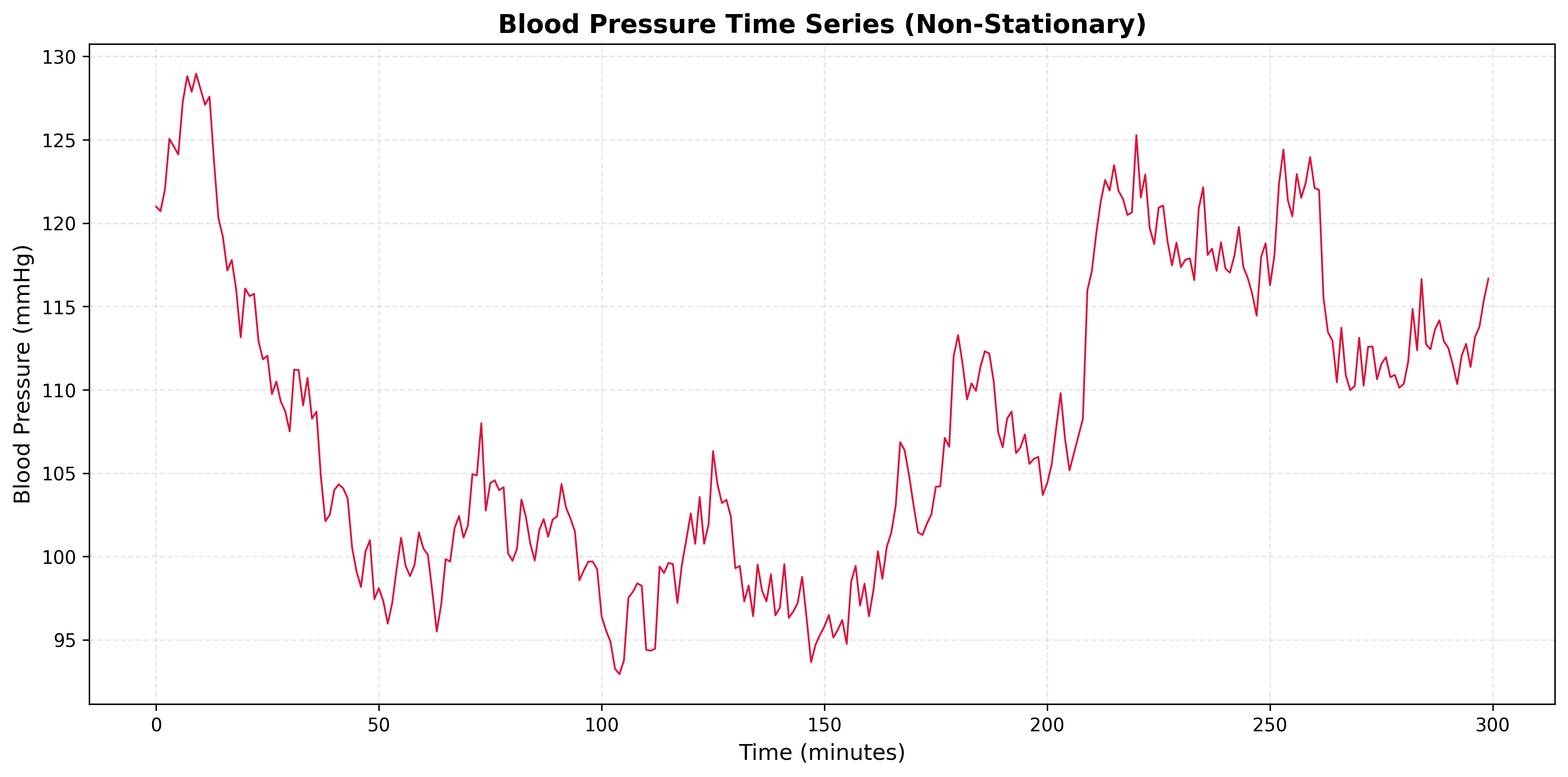

Problem 4.2

Consider a blood pressure time series where the ACF shows:

- Very slow decay, remaining above 0.5 even at lag 20

- No clear periodic pattern

- Gradual decrease rather than sharp cutoff

- What does this indicate about the process?

- What preprocessing step might be necessary?

- What model would be appropriate after preprocessing?

- Generate a synthetic blood pressure time series and plot the series and ACF.

Solution 4.2

Key

1. Process: Non-stationary—likely a random walk or unit-root process. Very slow ACF decay with no cutoff is typical of integrated (I) series.

2. Preprocessing: First-order differencing is needed. The differenced series should have a fast-decaying ACF (stationary).

3. Model: For the original series, use ARIMA(1, 1, 0): d = 1 from differencing; the differenced series can be modeled as AR(1).

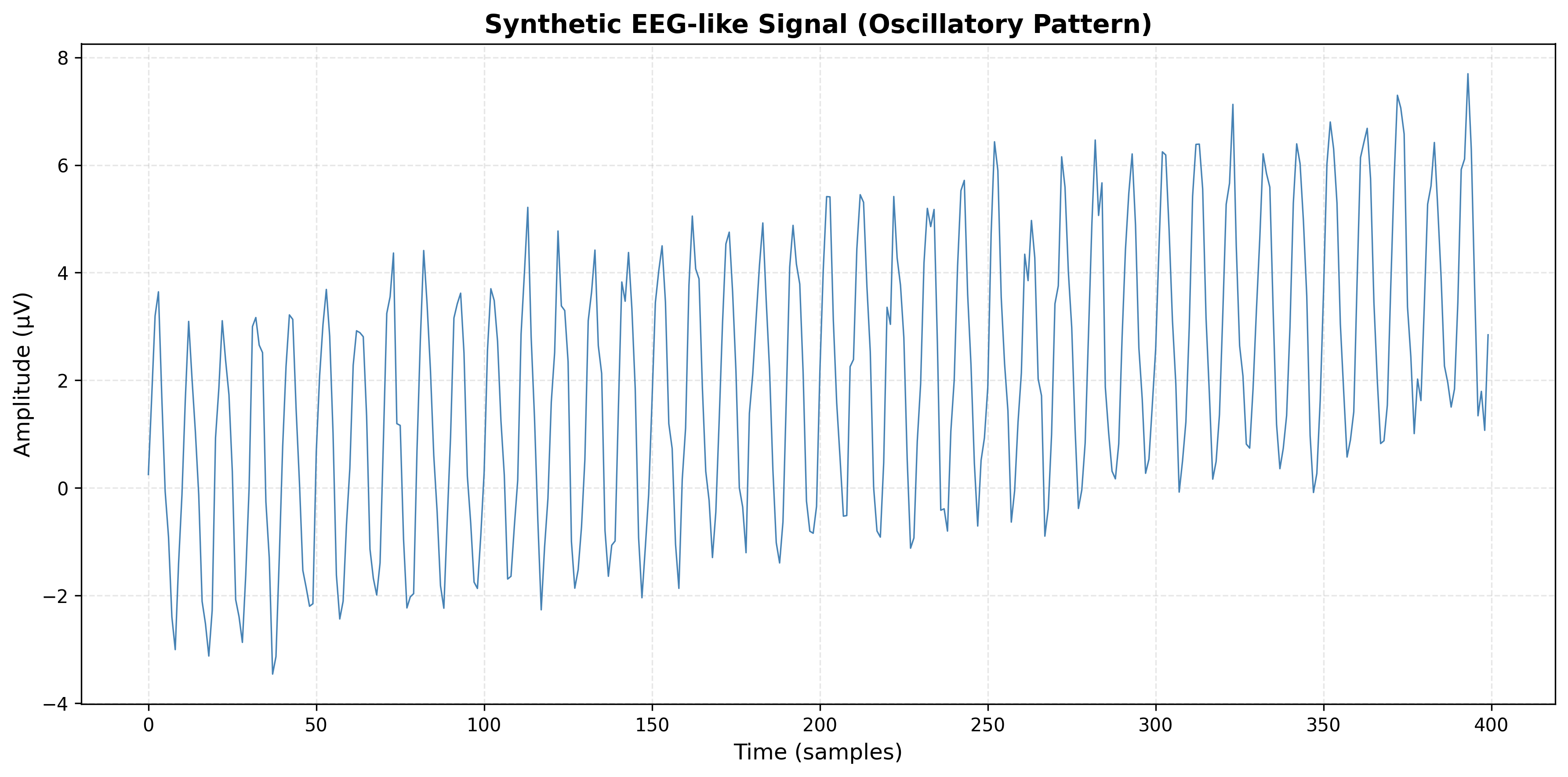

Problem 4.3

Consider an EEG-like signal where the ACF shows:

- Oscillatory pattern with period approximately 10 time steps

- Significant autocorrelation at lags 10, 20, 30

- Decay in amplitude of oscillations over time

- What does this indicate about the signal?

- What type of seasonality is present?

- Would a seasonal ARIMA model be appropriate?

- Generate a synthetic EEG-like signal and plot the series and ACF.

Solution 4.3

Key

1. Signal: Strong periodic component with period about 10 (e.g. alpha rhythm in EEG). ACF peaks at 10, 20, 30 confirm the period.

2. Seasonality: Deterministic or stochastic seasonality with period 10. The decaying amplitude of ACF oscillations is common when there is both seasonal and non-seasonal dynamics.

3. SARIMA: Yes. A SARIMA model is appropriate, e.g. SARIMA(1, 0, 1)(1, 0, 1)₁₀, where the seasonal order (1, 0, 1)₁₀ captures the period-10 component.

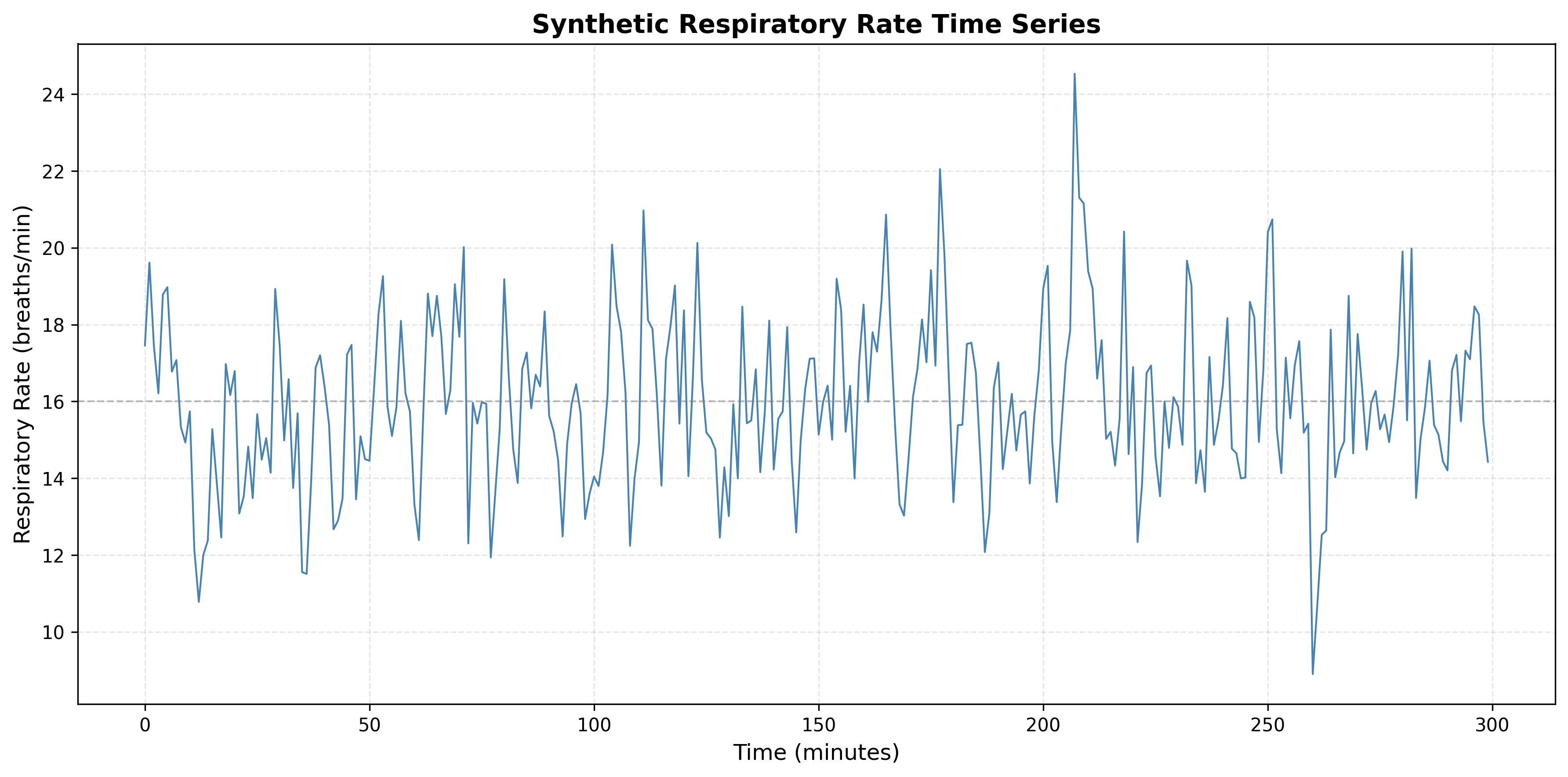

Problem 4.4

Consider a respiratory rate time series where the ACF shows:

- Sharp cutoff after lag 2

- ρ(1) ≈ 0.6, ρ(2) ≈ 0.3

- ρ(k) ≈ 0 for k > 2

- What type of process does this indicate?

- What is the memory length?

- What model order would be appropriate?

- Generate a synthetic respiratory rate time series and plot the series and ACF.

Solution 4.4

Key

1. Process: MA(2)—ACF cuts off after lag 2, so a moving average of order 2 fits.

2. Memory length: 2 time steps; correlation is only with the last two lags.

3. Model order: MA(2) or ARIMA(0, 0, 2).

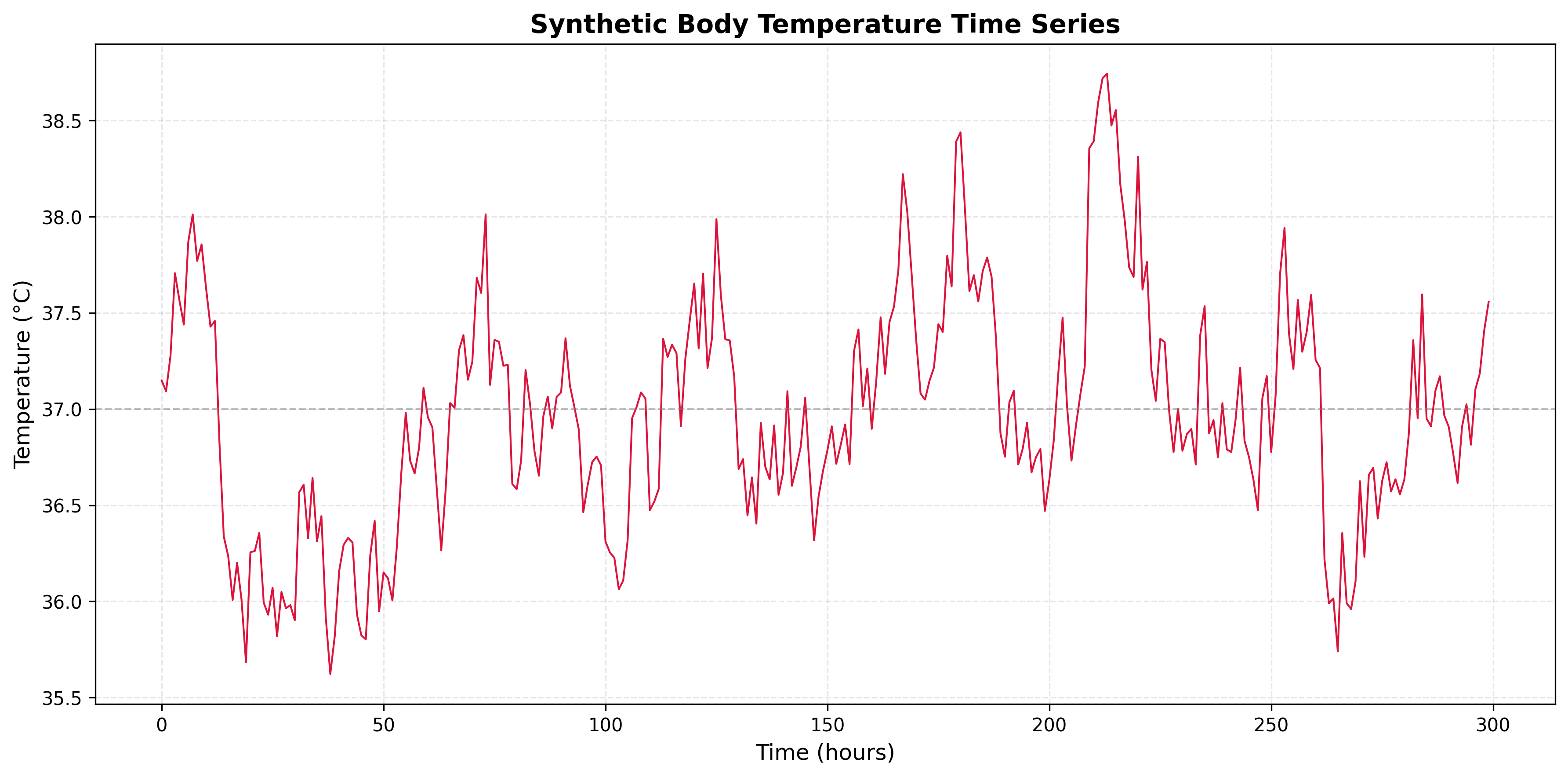

Problem 4.5

Consider a body temperature time series where the ACF shows:

- Exponential decay starting at ρ(1) ≈ 0.9

- Gradual decrease: ρ(5) ≈ 0.5, ρ(10) ≈ 0.2

- All values positive, no oscillations

- What type of process does this indicate?

- What is the approximate memory length?

- Would deep learning provide significant advantages over traditional methods?

- Generate a synthetic body temperature time series and plot the series and ACF.

Solution 4.5

Key

1. Process: AR(1) with a high coefficient (φ close to 1). Exponential decay with ρ(1) ≈ 0.9 and all ρ(k) positive is classic AR(1).

2. Memory length: Effective memory ~10–15 steps—the lag where ρ(k) drops below about 0.2. For AR(1), ρ(k) = φ^k, so φ = 0.9 gives ρ(10) ≈ 0.35 and ρ(15) ≈ 0.21.

3. Deep learning: Usually not necessary. A linear AR(1) model fits this pattern well. Consider deep learning only if you have evidence of nonlinearity or very long-range dependence.

Summary

This problem set covers:

- Numerical ACF Calculation: Manual computation of autocovariance and autocorrelation, including edge cases (constant series, zero variance).

- Mean Removal Effect: Understanding why mean removal is essential for correct autocorrelation computation and avoiding spurious correlations.

- ACF Pattern Interpretation: Identifying process types (white noise, trend, seasonality, AR, MA) from ACF plots with Python visualizations.

- Physiological Time-Series: Applying ACF analysis to real-world biomedical signals, determining appropriate models, and assessing when advanced methods are needed.

Each solution includes a Key (short answer or numerical result) and an Explanation (formulas used, step-by-step derivation where helpful, and interpretation). Python code is provided where useful for illustration. Suitable for undergraduate students.